The SAARCFINANCE Seminar on "Trading in Local Currencies: Problems and Prospects for the SAARC Countries" took place at a hotel in Chattogram under the auspices of the SAARCFINANCE Wing, Research Department of Bangladesh Bank. The inaugural session was graced by Abdur Rouf Talukder, Governor of Bangladesh Bank, as the chief guest, and Dr. Md. Khairuzzaman Mozumder, Secretary of the Finance Division, Ministry of Finance, joined as a special guest. The seminar was attended by delegates from the central banks of SAARC member countries, including those present in person from Bangladesh, Bhutan, India, Nepal, and Sri Lanka, as well as those attending online from Pakistan and the Maldives. Notably, Afghanistan was unable to participate, either in person or virtually.

The seminar aimed to explore the potential strategies and policies among the emerging economies of South Asia to reduce dependence on major global currencies such as the US dollar, Euro, and Pound sterling. Discussions focused on identifying ways to reduce transaction costs, minimize exchange rate volatility, and enhance regional economic integration. The event also included a meeting of a collaborative study team titled 'Local Currency Settlement in the Case of SAARC Countries' on the sidelines.

During the inaugural session, Dr. Md. Habibur Rahman, Deputy Governor of Bangladesh Bank, emphasized the benefits of trading in local currencies, such as reducing pressure on Forex reserves, enhancing bilateral trade, and lowering transaction costs. He also outlined the challenges, including exchange rate risk, currency convertibility issues, and the need for strong financial infrastructure and market confidence. Dr. Aditya Gaiha, Chief General Manager (in-charge) from the Reserve Bank of India (RBI), highlighted the importance of local currency trading for policy makers, central banks, and economic stakeholders, emphasizing its significance in addressing challenges exacerbated by post-COVID conditions and geopolitical tensions.

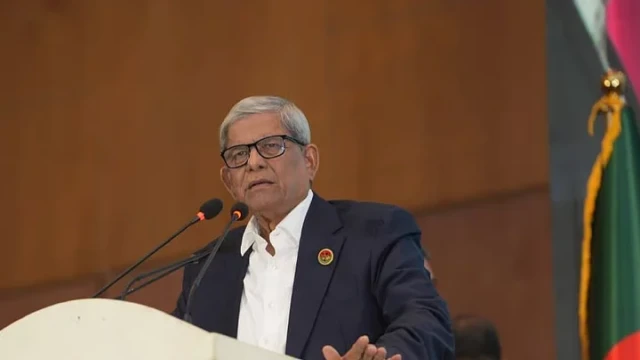

Dr. Md. Khairuzzaman Mozumder, Secretary of the Finance Division, Ministry of Finance, stressed the importance of reducing reliance on dominant currencies for the SAARC region, citing Bangladesh's ongoing efforts, including bilateral trade agreements with India using local currencies. He underscored the potential benefits of local currency trading in enhancing economic resilience, regional integration, and growth. BB Governor Abdur Rouf Talukder emphasized the strategic importance of trading in local currencies for reduced US dollar dependency, economic stability, and regional integration. He discussed Bangladesh's policy changes and digital financial technologies to facilitate this trade and urged collaborative efforts to overcome challenges.

The seminar provided a platform for the exchange of information and experiences among the SAARC countries, uncovering various aspects of trade strategies in local currencies and ensuring their development in these regions. Key issues addressed included the challenges of transitioning to local currency trading, the impact on existing trade agreements, and the readiness of financial institutions to support such initiatives. The event aimed to foster collaborative efforts to unlock the full potential of local currency trading and enhance regional economic resilience and integration.

Comment: