Dhaka, Bangladesh, Dec 15, (V7N )– The Bangladesh Bank (BB) is set to introduce the “Bank Resolution Act”, a comprehensive legal framework aimed at stabilizing the banking sector by enabling measures such as mergers, acquisitions, liquidations, recapitalization, and consolidation for struggling banks.

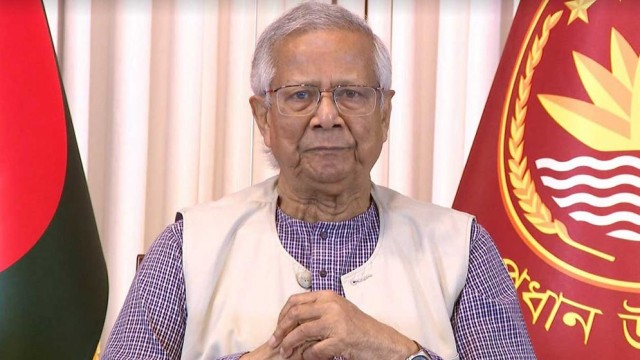

BB Governor Dr. Ahsan H Mansur shared updates on the legislation, stating, "We’ve completed the draft, and both the World Bank and the International Monetary Fund have reviewed it. Currently, it’s under evaluation by an international expert consultant."

Dr. Mansur emphasized that the new law would allow for swift policy actions to address crises in the banking industry, which has been plagued by liquidity shortages and loan-related irregularities.

The central bank has already initiated reforms, including the formation of a task force to assess and stabilize the struggling banking sector. Measures include:

Liquidity support for crisis-hit banks.

Dissolution of boards in 12 banks to curb undue influence from shareholder families.

Asset Quality Reviews (AQRs) by international firms like Deloitte to evaluate loan recoverability.

Collaborations with global institutions like the World Bank, IMF, and ADB for technical assistance.

Dr. Mansur detailed how the banking sector suffered during the previous regime, citing that Taka 2.5 trillion was siphoned by a few families with support from the ousted Awami League government. As a result, 10-11 banks became financially unstable, leading to depositor panic.

“We’ve halted such offenses since taking office and are now working to recover the stolen money," Dr. Mansur said, adding that 10-20% of the funds could be retrieved from domestic assets.

Efforts are underway to repatriate laundered money with assistance from international agencies like the U.S. Department of the Treasury and the British Intelligence and Security Committee.

Despite the challenges, Dr. Mansur remains optimistic about the sector’s recovery, predicting stability within two to three years.

The "Bank Resolution Act" will serve as a critical tool in this effort, alongside ongoing collaborations with international partners to address financial irregularities and strengthen governance.

END/BUS/RH

Comment: