Dhaka, Jan 07 (V7N)— Despite positive developments in other sectors of the economy since August 5, the stock market continues to face challenges. Over the past five months, the Dhaka Stock Exchange (DSE) price index has dropped by 818 points, and market capitalisation has declined by approximately Tk 54,000 crore. Liquidity flow has also reduced significantly.

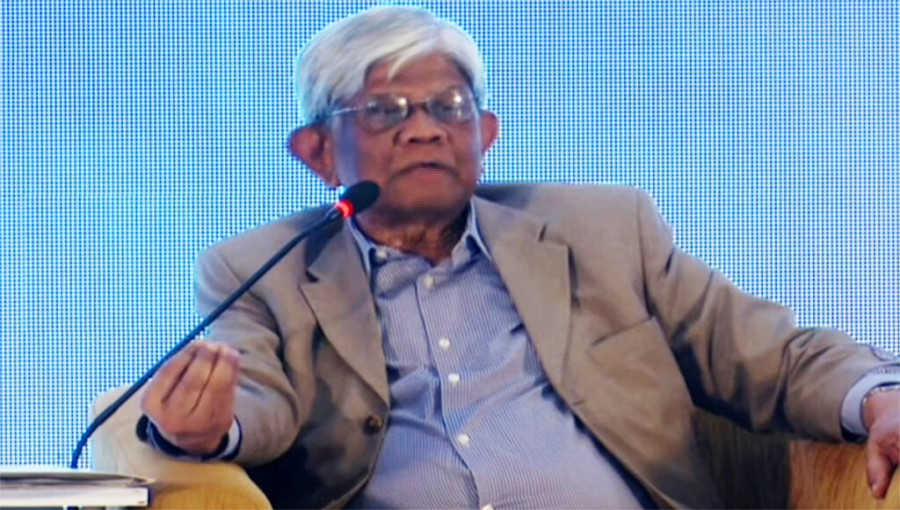

In response to the ongoing crisis, Dr. Salehuddin Ahmed, the interim government’s financial advisor, held a stakeholder meeting organised by the DSE on Tuesday. He assured participants that reforms are being implemented to strengthen the stock market, though he acknowledged the temporary challenges these reforms might bring.

“All reforms come with some pain, and the stock market reform process is no exception,” Dr. Ahmed said. He emphasised that the interim government is committed to building a sustainable and robust stock market, free from the biases of the past.

Highlighting structural issues, Dr. Ahmed noted that Bangladesh's economy is overly reliant on bank loans, which undermines sustainability. “A bank-dependent economy is not sustainable. Often, industrial enterprises rely on bank loans and fail to repay them. This creates long-term vulnerabilities.”

Dr. Ahmed also addressed the lack of participation by high-quality companies in the stock market. He said, “Our stock market lacks depth. Many good companies avoid the market because they do not want to comply with corporate governance requirements or face public scrutiny. However, increasing the market’s depth is crucial.”

The meeting was attended by representatives from key financial institutions, including the Bangladesh Securities and Exchange Commission (BSEC), Bangladesh Bank, National Board of Revenue (NBR), Chittagong Stock Exchange, Brokers Association, Merchant Bankers Association, Central Depository Bangladesh Limited (CDBL), Investment Corporation of Bangladesh (ICB), and the Financial Reporting Council.

Stakeholders at the meeting expressed optimism about the reforms and called for collaborative efforts to address the current challenges in the stock market.

END/MSS/AJ

Comment: