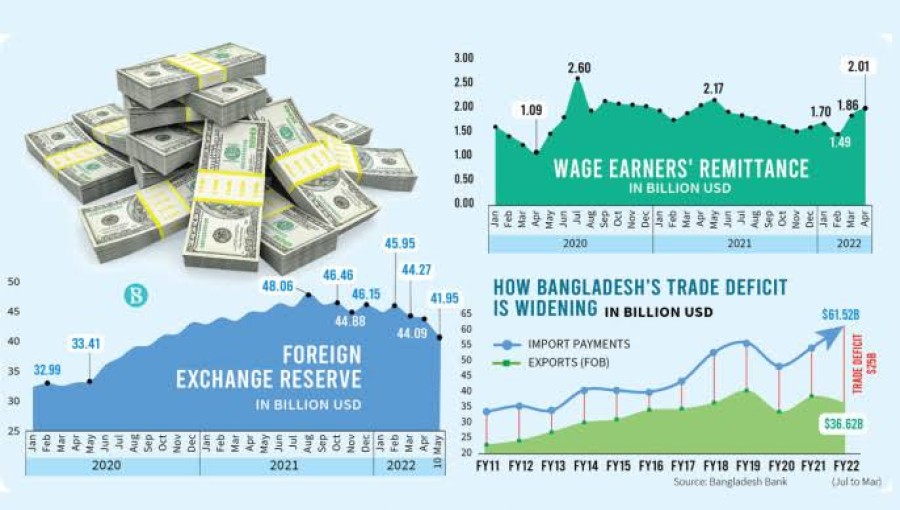

Ahead of Eid, Bangladesh experienced a robust inflow of remittances and a slight uptick in export income, leading to a significant increase in foreign currency reserves. As a result, the country's gross reserves have now surpassed $20 billion, reaching $25.73 billion, according to data from the Central Bank.

The latest figures reveal a steady rise in reserves compared to previous months. At the end of March 27, reserves stood at $19.96 billion, which increased to $20.64 billion by April 8. This positive trend underscores the country's growing capacity to manage its external financial obligations.

However, there remains a crucial aspect of Bangladesh Bank's reserves that is not publicly disclosed—the net or actual reserves, which are only shared with the International Monetary Fund (IMF). Sources familiar with the matter suggest that the country's expendable real reserves are currently around $15 billion, highlighting the need for prudent management to ensure stability in the face of economic challenges.

Despite the recent increase in reserves, Bangladesh still faces the challenge of meeting its import expenses, which average around $6 billion per month. Ideally, a country should maintain reserves equivalent to at least three months' worth of import costs to ensure financial resilience. With reserves hovering around this threshold, Bangladesh finds itself at the lower end of the standard benchmark.

Central Bank officials attribute the rise in reserves to a surge in remittances from expatriates ahead of Eid, coupled with an increase in export flow. These factors have contributed to bolstering the country's foreign exchange reserves, signaling positive momentum for its economy.

The accumulation of foreign currency reserves is a critical indicator of a nation's economic strength and ability to withstand external shocks. Bangladesh's recent achievement of surpassing the $20 billion mark in reserves reflects its resilience and potential for further growth in the global economic landscape.

Comment: