Bangladeshi consumers have doubled their share of wallet spending on essentials compared to pre-pandemic levels, said David Mann, chief economist of Asia Pacific, and Middle East and Africa (MEA) at Mastercard Economics Institute (MEI).

He made the remarks during a roundtable discussion on the "Global and Bangladesh Outlook and Risks" organised by MEI today (27 June) at the Sheraton Dhaka hotel.

David Mann, who was a keynote speaker at the event, said, "The doubled spending is driven by rising prices of essentials at the cost of discretionary spending. Consumer spending on groceries and electronics sees the highest stickiness to digital channels in the post-pandemic period."

"The USA may cut the policy rate several times this year. If this happens, it would be good news for Bangladesh. Bangladesh's remittance income has been rising in recent months, however, the import spending is also rising." he added.

"E-commerce is booming in Bangladesh. Consumers mainly use this platform for purchasing beauty and personal care, electronics and food." David Mann further said.

Mentioning the inflation will tame in the next FY, he added that "Persistently high inflation is weighing on consumer purchasing power."

"MEI expects inflation to increase to 9.8% YoY for FY24 before easing to 8% YoY for FY25," he said.

Mastercard also forecasted that the central bank may hike the policy rate to 9% in 2025 from 8.5% to control inflation.

"Bangladesh's economy continues to grapple with challenges due to weak domestic and external demand. MEI's GDP growth outlook stands at 5.8% YoY for FY24 and 5.7% YoY for FY25," the chief economist further said.

Syed Mohammad Kamal, country manager of Mastercard said, "Mastercard is bringing 20% of the total remittance of Bangladesh. As per our experiences, the introduction of a crawling peg system in the exchange rate regime in May along with greater alignment between official and unofficial exchange rates are acting as tailwinds for increased remittances."

Syed Mahbubur Rahman, managing director and chief executive officer of Mutual Trust Bank, said "Inflation is pushing marginal people below the poverty line, which is not good for our country. As well as, the cost of doing business is also rising as the deposit and lending rate has hiked.

"Though we made the right decision about exchange rate lately, the difference between formal and informal dollar rate narrowed down after introducing crawling peg," he added.

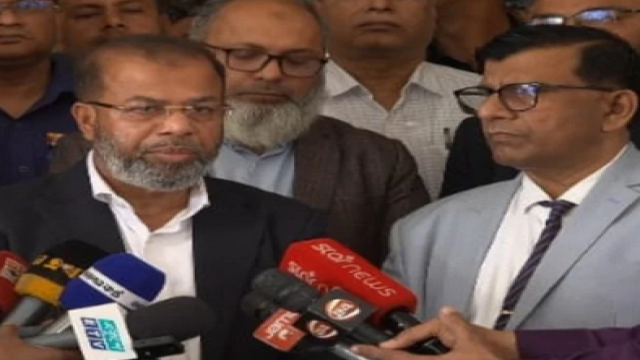

In the concluding remarks, Atiur Rahman, former governor of the Bangladesh Bank said, "Multiple exchange rates have hampered the market. It is better to follow the market determined exchange rate, otherwise the market will punish you, that's the rule."

The programme further discussed the macroeconomic environment on a global scale, with a specific focus on South Asia and Bangladesh.

It provided insights into various aspects including growth projections, inflation trends, interest rates, foreign exchange dynamics, export performance, remittance flows, excess savings, and credit markets.

Renowned economists along with the country heads of development partner organisations participated in the event. Managing directors, chief executive officers, deputy managing directors and senior officials of Mastercard's partner banks and fintech organisations, and managing directors and chief executive officers of local and multinational conglomerates in Bangladesh were also present at the event.

Comment: