Warner Bros. Discovery's share price dropped over 10 percent in after-hours trading following the announcement of a nearly $10 billion quarterly loss, primarily due to a substantial $9.1 billion write-down in the value of its cable network. This write-down highlights the significant challenges the legacy television industry faces.

The company's total revenues for the three months ending June 30th were $9.7 billion, down from almost $10.4 billion during the same period last year. The net losses amounted to almost $10 billion, a sharp increase compared to the second quarter of 2023.

The write-down was attributed to the discrepancy between the company's market capitalization and book value, along with ongoing softness in the US linear advertising market and uncertainties related to affiliate and sports rights renewals, including concerns about the National Basketball Association (NBA) rights for its cable subsidiary TNT.

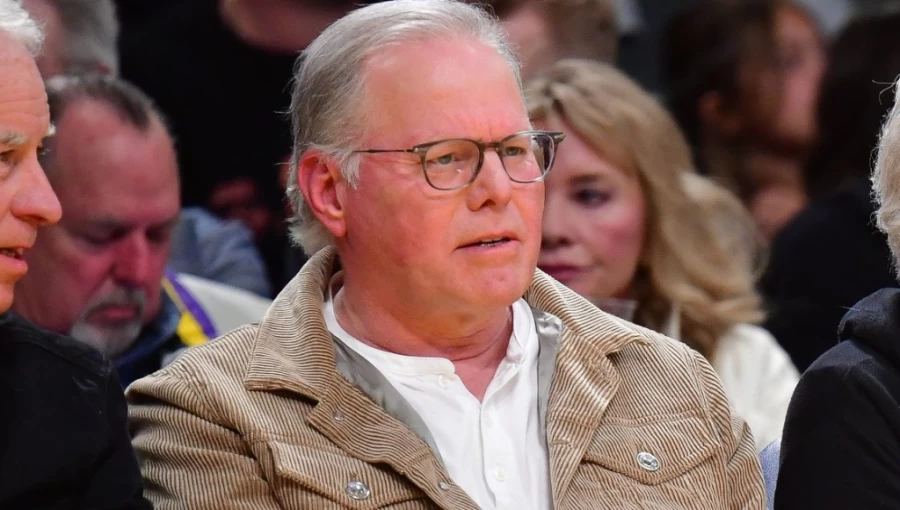

Warner Bros. Discovery was formed two years ago from the merger of WarnerMedia and Discovery, with David Zaslav as the chief executive. Despite the significant loss, Zaslav emphasized that the company's direct-to-consumer business is performing well and has substantial growth potential. However, he acknowledged the tough conditions in the legacy business, indicating the ongoing transition the company is experiencing.

Comment: