The National Board of Revenue (NBR) is considering a new mandate that requires proof of submission of a tax return (PSR) when renting community centers or venues for weddings and other events as part of an effort to broaden the tax base.

Additionally, this mandate will also apply to obtaining or renewing licenses for hospitals, clinics, or diagnostic centers, according to sources familiar with NBR's fiscal policy initiatives.

Currently, a PSR is necessary for accessing 43 different services.

An anonymous senior official at the NBR stated, "We are planning to expand the tax base by making PSR mandatory for renting venues for weddings and other social events. This requirement will also extend to obtaining new licenses or renewals for medical facilities."

The official noted that many individuals who spend large sums on events do not possess a tax identification number (TIN) and are thus outside the tax net. "We aim to include these affluent individuals in the tax system," he added.

Experts view this move positively, though industry insiders fear it could adversely impact business.

Dr. Syed Md Aminul Karim, a former NBR member, told TBS, "The government should integrate these individuals and entities into the tax net. Despite significant turnover in these sectors, the government is not receiving adequate tax revenues."

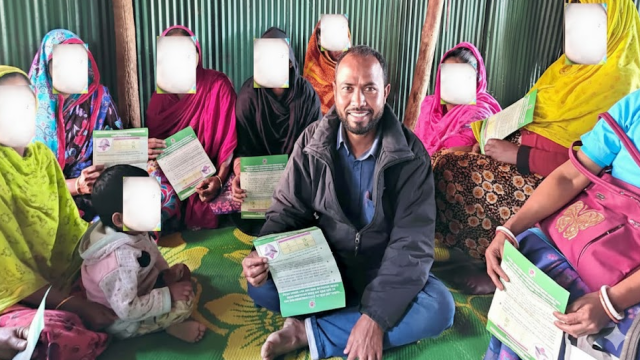

The Bangladesh Community Centre, Convention Hall, and Catering Service Association reports over 4,000 centers currently operating nationwide. The Directorate General of Health Services notes that there are 16,500 clinics, diagnostic centers, and hospitals in operation.

Shah Zakir Hossain, president of the community center association, expressed concerns, "PSR collection is NBR's responsibility. Imposing this on us could strain our customer relations and negatively impact our business."

A senior official from the health ministry, also requesting anonymity, commented, "TIN is already checked during license issuance. We are prepared to comply with any decision from government authorities."

Comment: