Dhaka, Oct 05 (V7N): Prominent businessmen in Bangladesh have appealed to the interim government to take decisive actions to lower interest rates, stimulate local demand for goods, and eliminate barriers to exports.

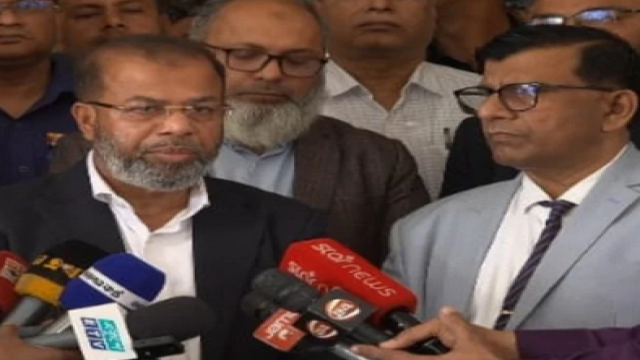

During a seminar hosted by the Dhaka Chamber of Commerce and Industry (DCCI) on October 5, they emphasized that a return to normalcy for businesses hinges on improvements in the country's law and order situation.

The event, titled "Current State of the Economy and Outlook of Bangladesh," took place at the DCCI office in Motijheel, where DCCI President Ashraf Ahmed noted that ongoing tensions regarding law enforcement, administrative actions, bank loan interest rates, and the foreign exchange crisis could lead to economic contraction. He warned that such conditions would hinder job creation and exacerbate inflation.

Ahmed stressed the necessity for a business-friendly environment conducive to investment and operations, urging the government to facilitate this while also emphasizing the need for businessmen to meet their responsibilities.

Former FBCCI President Mir Nasir Hossain highlighted that the current effective interest rate stands at around 17%. He expressed frustration over the Bangladesh Bank's policy that threatens to declare businesses defaulters after a single missed installment, questioning the intent behind such measures. “It seems designed to cripple businesses,” he remarked.

Hossain called for immediate action to enhance the law and order situation, reform the National Board of Revenue, and reduce interest rates.

Mohammad Hatem, President of the Bangladesh Knitwear Manufacturers and Exporters Association, pointed out that worker unrest often arises from external instigation, questioning why only ready-made garment workers were protesting amidst inflation affecting all sectors. He cautioned that rising bank loan interest rates could lead to 90% of businessmen becoming defaulters under new regulations starting in March. Hatem, who is also the managing director of MB Knit Fashion Ltd, identified the ongoing gas crisis as the most pressing challenge affecting production timelines and wages.

Syed Nasim Manzur, former President of the Metropolitan Chamber of Commerce and Industry, voiced concerns over the prevailing insecurity among businessmen and the decline in local product demand. He argued that if this trend persists, the number of loan defaulters will rise. Manzur, also managing director of Apex Footwear Limited, stated that interest rates of 14-15% for the manufacturing sector are unsustainable. He urged the government to take steps to restore trust among businesspeople.

Ahsan Khan Chowdhury, Chairman of Pran-RFL Group, expressed anxiety about workplace safety and the effectiveness of industrial police, noting that the interest rate has surged to 16%. He warned that unless reduced, this would lead to increased defaults and hinder job creation. He called for a special allocation from the central bank’s foreign exchange reserves to facilitate the opening of Letters of Credit (LCs).

Former DCCI President Shams Mahmud echoed these concerns, reflecting on the rising job demand in the country. He referenced a recent job fair organized by Pran Group that attracted 2,500 attendees, compared to just 200 in previous years.

Syed Mohammad Kamal, country manager for Mastercard in Bangladesh, attributed the decline in shopping mall sales to deteriorating law and order and traffic congestion, highlighting a substantial drop in digital transactions during internet shutdowns.

Ambareen Reza, managing director of foodpanda Bangladesh, underscored the significant effects of recent events on the digital sector and the urgent need for low-interest loans to support small businesses.

M Masrur Reaz, Chairman of Policy Exchange Bangladesh, raised concerns about the lack of improvement in law enforcement discipline despite legal progress. He urged the government to focus on sectors beyond banking, emphasizing that restoring business confidence requires immediate action.

END/MSS/RH

Comment: