New York, Dec 22, (V7N) - At 60 years old, I continue to work two jobs to pay off my student loans. My story is not unique—millions of older Americans are facing similar struggles, working into their golden years to manage unpayable student debt.

A Lifetime of Work and Debt

Growing up in Alabama, I worked multiple jobs as a teenager to support myself. As an adult, I became a florist and administrative assistant to provide for my family after my husband passed away prematurely. Now, in my 60s, I still work two jobs—at a health administration office and as a host at a local diner—to pay off my student loans.

I took on student loans to better provide for my family, thinking it would lead to a more secure future. But instead, I now find myself taking money from my retirement savings just to keep up with my debt, which is higher than my mortgage payments.

The Growing Crisis

Older Americans are facing a student debt crisis. Over the past two decades, the number of adults 60 and older with student loan debt has increased sixfold, and their debt has multiplied nearly 20 times. Today, 9 million Americans age 50 and older carry over $400 billion in student loans.

Despite decades of payments, my debt has ballooned. What started as an $80,000 loan has now grown to more than $200,000 due to 20 years of accumulating interest. Each month, I accumulate $1,100 in interest alone.

The Unseen Struggle of Older Borrowers

Many older borrowers, like me, are ineligible for student debt relief programs. These include Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans. Even after 20, 30, or 40 years of paying off loans, many of us still see our balances grow instead of shrink. Meanwhile, our incomes continue to decline, and we are left struggling to make ends meet.

For many older borrowers, Social Security payments barely cover living expenses, and adding student loan payments makes it even harder. If payments aren’t made, loans may go into default, leading to consequences like garnished wages or Social Security checks.

The Reality of Death Discharge

Here's the harsh reality: When we die, our student debt is automatically canceled. Known as a "death discharge," this process wipes out billions of dollars of student loan debt from deceased borrowers. But until that happens, we continue to face the crushing burden of debt. The government continues to charge interest and even garnishes our wages or Social Security benefits.

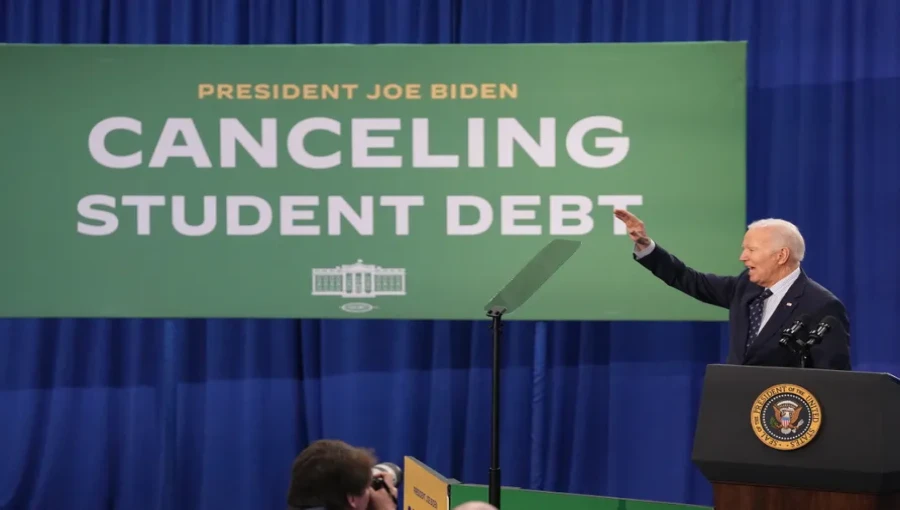

A Call for Action

For many of us, the solution lies in discharging our student debt before we pass away. This would not only allow us to enjoy our later years in dignity but would also support families and communities. We are essential workers—teachers, nurses’ aides, social workers, and more—contributing to society despite the weight of student debt.

Cancelling this debt is a practical and feasible solution. The Department of Education has the legal authority to discharge loans based on the debtor’s age. This has been allowed since 1966, but it’s never been applied on a large scale. With the right action, President Biden can use this authority to provide relief for millions of older Americans.

Conclusion

Many older Americans, like myself, are facing the impossible task of repaying student loans that were meant to improve our lives but have instead become an insurmountable barrier to retirement. As we near the end of our working years, we urgently need President Biden to take action to discharge these debts. It is a matter of justice and dignity for those of us who have worked tirelessly, year after year, only to be burdened by a debt that we will never fully pay off.

END/SMA/NYC/AJ/

Comment: