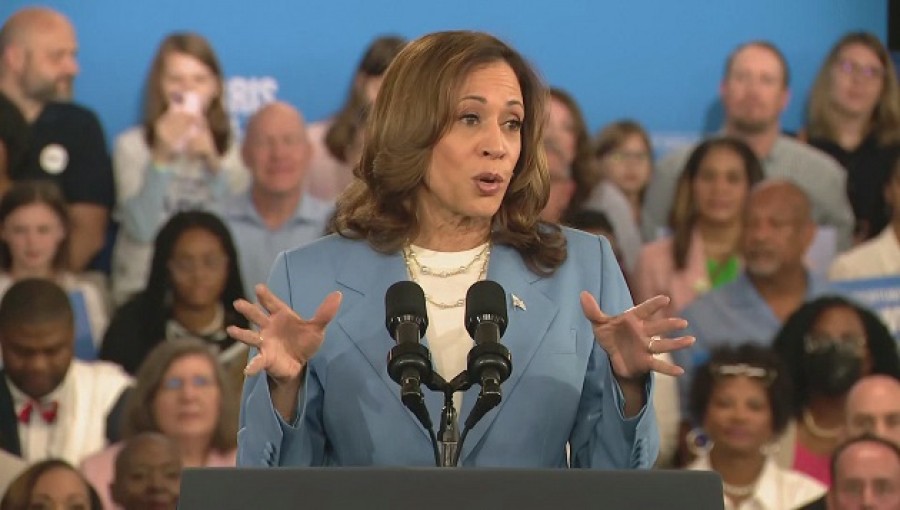

Kamala Harris has outlined a series of economic proposals aimed at supporting middle-class Americans as part of what she calls an "opportunity economy" in her bid for the presidency. Key elements of her plan include a new child tax credit of up to $6,000 for families with infants, tax cuts for families with children, and measures to lower prescription drug costs. She also plans to address the housing crisis by advocating for the construction of 3 million new housing units over four years and offering tax incentives to homebuilders focusing on first-time buyers.

Harris emphasized her focus on strengthening the middle class, arguing that when the middle class is strong, the nation is strong. She contrasted her economic approach with that of her opponent, Donald Trump, particularly criticizing his proposal for new tariffs on imports, which she referred to as a "national sales tax" that would raise prices on essential goods.

However, her proposals have faced criticism from Republicans and some industry groups, who argue that they could increase inflation and the federal deficit. The nonpartisan Committee for a Responsible Federal Budget estimates that Harris' economic plan could increase deficits by $1.7 trillion over a decade.

Harris' plan also includes a federal ban on price gouging in the food and grocery sectors, with strict penalties for companies that violate the rules. She is committed to maintaining Biden's promise not to raise taxes on individuals earning $400,000 or less annually, contrasting her tax policies with Trump's, particularly regarding corporate tax cuts.

Overall, Harris is positioning her economic policies as a way to appeal to working Americans who are concerned about high costs and economic security.

Comment: