Dhaka, April 22, (V7N) – Bangladesh has initiated a flurry of urgent actions to expand its air cargo capacity, responding to India's abrupt suspension of third-country transshipment facilities—a move that has sent shockwaves through the country’s export-reliant economy.

The Civil Aviation Authority of Bangladesh (CAAB), in coordination with Biman Bangladesh Airlines, is fast-tracking the transformation of the country’s air freight infrastructure to address this challenges of additional cargo handling.

Dhaka is now focusing to upgrade facilities and reclaim its role as a viable export hub following.

According to sources at CAAB, Sylhet’s Osmani International Airport is set to begin dedicated international cargo operations from April 27, with Voyager Airlines scheduled to transport 60 tons of garments to Spain via the Middle East.

Chittagong’s Shah Amanat Airport is also undergoing preparations, while Saidpur and Lalmonirhat airports are being considered for expansion under Bangladesh Investment Development Authority’s (BIDA) initiatives.

Meanwhile, Hazrat Shahjalal International Airport (HSIA) in Dhaka—the country’s primary air cargo terminal—faces chronic overcapacity.

Designed to manage 300 tons per day, it routinely processes over 1,000 tons, resulting in delays, damaged consignments, and steep operational costs.

The long-anticipated third terminal, expected to open by October, 2025, is set to add 36,000 square meters of space and triple current handling capacity.

CAAB Chairman Air Vice Marshal Md Monjur Kabir Bhuiyan has confirmed Dhaka Tribune that a broad directive to expand capabilities and lower charges, stating that new staffing, cost cuts, and policy reforms are already underway.

Meanwhile, Biman is reportedly recruiting 400 additional ground handlers and transferring equipment to the newly activated hubs in Sylhet and Chittagong.

The urgency is compounded by concerns from exporters who have long favored foreign airports—especially in India and Sri Lanka—for their lower tariffs, faster handling times, and better infrastructure.

According to the Bangladesh Freight Forwarders Association (BFFA), it costs roughly $3per kg to ship goods from Dhaka to Europe, while Kolkata offers similar services for about $2per kg.

Handling and scanning charges at HSIA reach up to 16 cents per kg, compared to just 4–5 cents in Indian terminals.

Exporters like Mostafa Motin, who once moved goods through Dhaka, have turned to Kolkata and Colombo, citing not only lower costs but also predictable service.

“It’s not just about the money,” one exporter noted. “Time is everything when buyers are waiting.”

Aviation analyst Kazi Wahidul Alam pointed out that many international airlines have scaled back their operations due to uncompetitive pricing and poor service.

The ripple effect is visible in Chittagong, where 15 of 17 foreign carriers have ceased operations over the past three decades.

In recent years, SpiceJet, Jazeera Airways, and Oman Air have exited, highlighting the mounting pressure on the sector.

Still, authorities remain optimistic. The new third terminal in Dhaka is projected to boost annual cargo handling capacity from 200,000 to 546,000 tons. Officials also hinted at ongoing talks with carriers from the UAE, Sri Lanka, and the Maldives to develop alternative routes.

Despite disruptions, exporters see the crisis as a chance to push for long-overdue reforms. Mohammad Hatem, a leader of the Bangladesh Exporters Association, criticized the monopolized and inefficient airport handling system, saying the lack of competition has driven up prices without improving service. Others highlighted that untrained staff and outdated systems continue to compromise cargo integrity.

In response, the Ministry of Civil Aviation and Tourism is forming a task force to streamline handling fees, unify regulations, and attract new international partnerships.

Following India’s abrupt discontinuation of transshipment privileges, Bangladesh is accelerating the expansion of its air cargo infrastructure. To maintain uninterrupted exports, particularly of crucial sectors like readymade garments, the government is taking urgent steps to bolster capacity, hire additional manpower, and reduce transportation costs.

The CAAB and Biman Bangladesh Airlines, the country’s sole ground-handling agent, are jointly implementing initiatives to streamline cargo operations.

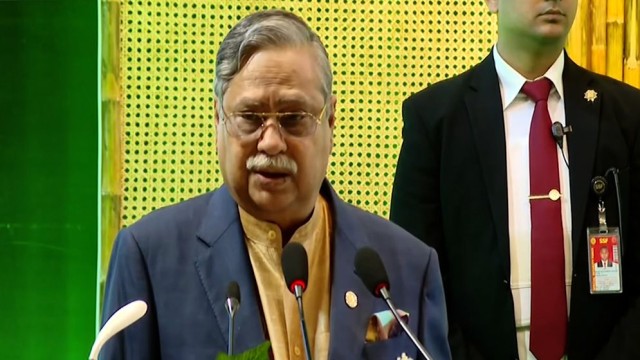

“We’re working closely with Biman Bangladesh Airlines to revise the current civil aviation and ground-handling charges in order to make air cargo services more affordable,” said CAAB Chairman Air Vice Marshal Md Monjur Kabir Bhuiyan on Friday.

He added that the government is forming a task force led by the Ministry of Civil Aviation and Tourism to simplify and reduce fees related to cargo operations, ensuring alignment across all stakeholders involved.

“Even in the face of external disruptions, we’ve received a clear directive from the highest levels to ensure uninterrupted air cargo transport. We expect to announce reduced handling charges very soon,” Bhuiyan said.

In anticipation of growing demand, CAAB has already appointed additional staff at Hazrat Shahjalal International Airport’s cargo terminal. Full-scale cargo operations at Sylhet’s Osmani International Airport will commence on April 27, with Chattogram’s Shah Amanat International Airport soon to follow. Measures are also being taken to accelerate customs clearance processes.

On Friday, the CAAB chairman visited Sylhet Airport to inspect preparations for the launch of cargo operations. He instructed officials to ensure that the terminal is fully operational by April 27.

Praising the cargo terminal at Sylhet as highly capable, Bhuiyan noted: “Before the launch of the third terminal at Hazrat Shahjalal International Airport, our existing infrastructure will soon be able to handle two to three times more cargo.”

Echoing the urgency, Dr Md Shafiqur Rahman, Managing Director and CEO of Biman Bangladesh Airlines, said steps are already underway to address the added pressure on the system caused by the halt in shipments through Indian ports. “We are hiring new cargo personnel to manage the increased load,” he said.

END/MSS/RH/

Comment: