In the proposed national budget for fiscal year 2024-25 (FY25), the government has suggested raising taxes and other duties on several products and services, making some summer essentials more expensive. Items such as ice cream, soft drinks, air conditioners, and refrigerators will see increased costs due to the addition of value-added tax (VAT) and supplementary duty (SD).

Price Up

- Ice Cream: Supplementary duty increased from 5% to 10%.

- Soft Drinks: Supplementary duty increased from 25% to 30%.

- Air Conditioners (ACs): 7.5% VAT imposed.

- Refrigerators and Freezers: 7.5% VAT imposed.

- Tobacco and Cigarettes: Higher duties applied.

- Cashew Nuts: Duties increased.

- Mobile Talk Time and Internet Data: Costs to rise.

- Furnace Oil, Lube Oil, Base Oil: Higher taxes.

- CNG/LPG Filling Stations, Conversion Kits, Cylinders: Increased costs.

- Power Plants: Increased taxes.

- Economic Zones: Additional taxes applied.

- Water Filters: Higher duties.

- LED Bulbs: Increased costs.

- Tourism Services: Higher duties.

Price Down

- Rice: Lower taxes.

- Cooking Oil: Reduced duties.

- Sugar: Reduced taxes.

- Powdered Milk: Lower taxes.

- Chocolate: Reduced duties.

- Laptops: Reduced taxes.

- Motorcycles: Lower duties.

- Dengue Test Kits: Reduced costs.

- Dialysis Filters and Circuits: Lower taxes.

- Cancer Treatment: Reduced costs.

- Electric Motors: Lower taxes.

- Aircraft Engines and Propellers: Reduced costs.

- Carpets: Reduced duties.

- Switches and Sockets: Lower taxes.

- Methanol: Reduced costs.

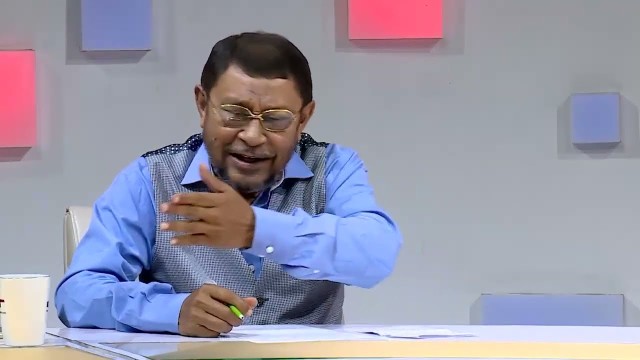

Finance Minister Abul Hassan Mahmood Ali presented the largest budget in the nation's history, contrasting sharply with the Tk786 crore budget introduced by Tajuddin Ahmad for FY1973. This marks the country's 54th budget and the 25th under the Awami League (AL) government across six terms. It is also the 21st budget under Prime Minister Sheikh Hasina's leadership but the first for Finance Minister Mahmood Ali.

The budget growth rate is lower than usual, increasing by less than 8% compared to the current year's budget, typically expected to grow by 10% to 12%. This latest budget is contractionary, with a projected GDP growth of 6.7%.

Comment: