Dhaka, JUne 26 (V7N) - Despite generous tax exemptions, many large multinational and domestic companies remain reluctant to list on the Bangladesh stock market. Policy uncertainty and complex regulatory hurdles continue to deter these companies from entering the capital market, industry experts and stakeholders noted during a recent discussion on the current state of Bangladesh’s stock market organized by the Dhaka Stock Exchange Brokers Association (DBA).

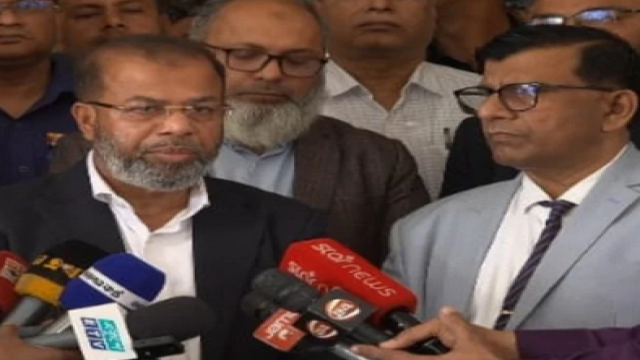

The panel discussion, held on Wednesday at the DSE Tower in Nikunja, featured prominent figures including Dr. Anisuzzaman Chowdhury, Special Assistant to the Chief Adviser; Khondkar Rashed Maksud, Chairman of the Bangladesh Securities and Exchange Commission (BSEC); Abu Ahmed, Chairman of the Investment Corporation of Bangladesh (ICB); Tapan Chowdhury, Managing Director of Square Pharmaceuticals; Javed Akhtar, Chairman and Managing Director of Unilever Bangladesh and President of the Foreign Investors’ Chamber of Commerce and Industry (FICCI); Mominul Islam, Chairman of DSE; and Saiful Islam, President of DBA.

Dr. Anisuzzaman Chowdhury emphasized the government’s serious commitment to stock market reform but urged patience, noting, “Reforms require careful consideration and time to implement. In some countries like Russia, rushed reforms led to collapse. We must proceed cautiously to ensure sustainable improvements.”

ICB Chairman Abu Ahmed pointed out that while multinational companies like Unilever are listed in neighboring countries such as India, Pakistan, and Nepal, they have yet to list in Bangladesh. “Companies like Unilever generate profits by doing business with the public, so accountability to the people should be a priority. Despite having only a few branches, Standard Chartered Bank manages billions in business, yet many domestic banks with hundreds of branches are listed. This is because they operate with public funds,” he explained. He also noted that unlike other countries that mandate multinational companies to list by relinquishing at least 20% of their shares, Bangladesh allows them to list with just 10% share release and still avail tax incentives.

Javed Akhtar added that tax breaks alone do not motivate multinationals to list. “There is significant policy uncertainty. Earlier, it was said that companies listing with a 10% share release would receive tax benefits, but later this was increased to full IPO requirements. Although corporate tax is set at 27.5%, the effective tax rate exceeds 40%, discouraging companies from listing.”

Tapan Chowdhury highlighted legal complexities and the stock market’s reputation as deterrents for large companies. “Another reason companies avoid the market is fear of not receiving fair valuation and the risk of retail investors incurring losses based on market volatility.”

Stock Market Reform Taskforce member A.F.M. Nesaruddin recalled India’s 2018 regulation requiring companies with annual turnover above 5 billion rupees to list. He advocated for similar coordinated policy formulation among BSEC, Bangladesh Bank, and the National Board of Revenue (NBR) in Bangladesh to streamline listing requirements.

BSEC Chairman Khondkar Rashed Maksud underscored the importance of social responsibility. “If Unilever’s products reach 20 million people with a profit of five taka each, such massive profits shouldn’t be retained solely by the company. Ownership should be shared with the public for social accountability.” He further suggested that if the government were to divest 5% from its 39% stake in a company, other shareholders holding 61% should similarly have the opportunity to share ownership.

DSE Chairman Mominul Islam stressed the need for transparency in financial reporting and auditing to restore investor confidence. He also expressed gratitude to the government for implementing market-friendly measures in the recent budget.

Overall, stakeholders agree that while tax incentives are important, addressing policy uncertainties, regulatory reforms, and improving transparency and governance are crucial to attracting large companies to Bangladesh’s stock market and fostering sustainable growth.

END/MRB/SMA/

Comment: