Dhaka, Nov 16 (V7N) – Bangladesh Bank Governor Ahsan H. Mansur has said that the majority of the capital of five Sharia-based banks has left the country, leaving no option but to merge them. He expressed regret that one of the country’s most dynamic Islamic banks was also closed in the process.

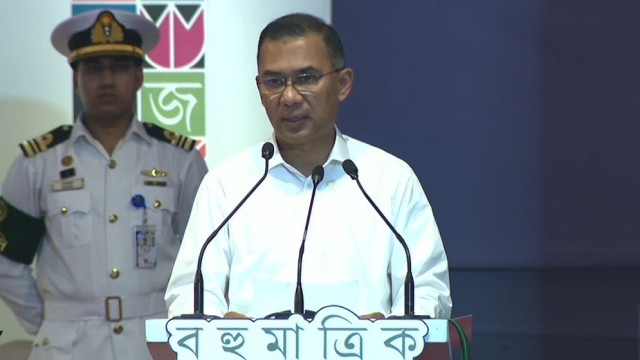

He made the remarks at the Bangladesh Islamic Finance Summit held at a hotel in Dhaka on Sunday. The Governor emphasized that transparency is essential to make the banking sector dynamic and prosperous. “For this, everyone’s participation, including investors, depositors, officials, and employees, is necessary,” he said, adding that proper governance would make the merger beneficial for the country’s economy.

Speakers at the summit highlighted that Islamic banking differs from conventional banking but has a stronger supervisory system. They stressed that transparency and accountability are vital for sustainability. They also recommended educating the public about Islamic banking, including how profits are earned and distributed, to build customer confidence.

The banks currently being merged are Exim Bank, First Security Islami Bank, Global Islami Bank, Union Bank, and Social Islami Bank. On November 5, Bangladesh Bank dissolved the boards of directors of these banks and appointed administrators, while initiating the formation of a new bank named Sammilit Islami Bank.

The summit underlined that with good governance and transparent operations, the merger could strengthen the Islamic banking sector and support broader economic growth.

END/SMA/AJ

Comment: