Sept 26, V7N - Asian stocks continued to rally on Thursday, driven by ongoing optimism over China's aggressive stimulus measures, which countered the global trend of declines in other markets. While Wall Street closed lower, Asian equities extended their gains, though there were early signs of some moderation in enthusiasm.

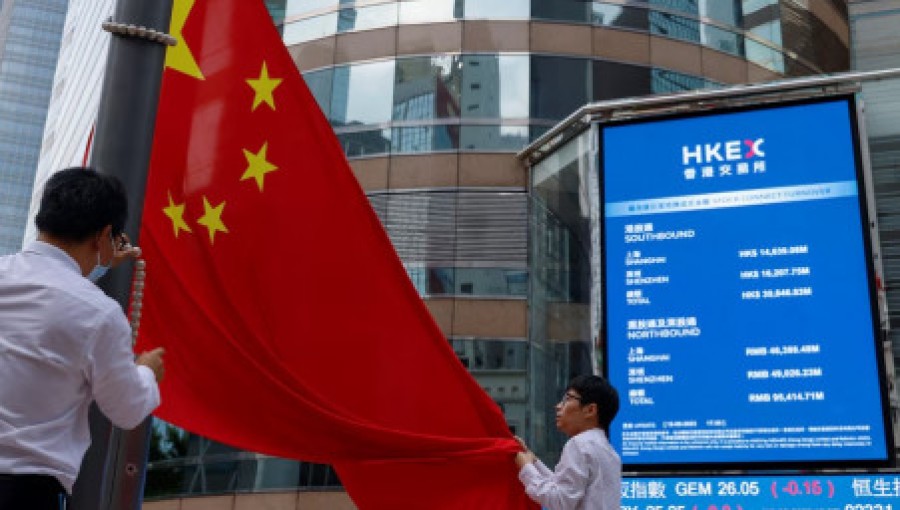

MSCI's broadest index of Asia-Pacific shares outside Japan surged by over 1%, reaching a two-year high. Japan's Nikkei climbed 2.4%, and Hong Kong's Hang Seng Index advanced 1.5%, while China's CSI300 blue-chip index reversed early losses to rise 0.3%. The rally was supported by reports that China is considering injecting up to 1 trillion yuan ($142.39 billion) into its largest state banks to stimulate the struggling economy.

Market attention was also focused on upcoming speeches by U.S. Federal Reserve policymakers, including Chair Jerome Powell, which may provide insights into the U.S. interest rate outlook. The release of the core Personal Consumption Expenditures (PCE) price index, the Fed's preferred inflation gauge, is anticipated on Friday. Investors are weighing the possibility of a 50-basis-point rate cut at the Fed's November meeting, with the chance of additional cuts by year-end.

Currency markets reflected the fluctuating expectations for U.S. rate moves, with the dollar gaining strength after a dip earlier in the week. The Australian dollar edged up, while the euro, sterling, and offshore yuan slightly retreated. Commodities saw marginal gains, with Brent crude futures and U.S. crude rising, while spot gold held steady near record highs.

END/BUS/RH/

Comment: