Dhaka, Oct 12 (V7N): The National Board of Revenue (NBR) has once again granted Grameen Bank income tax exemption, extending the facility until December 2029. This follows a four-year gap after the previous exemption expired on January 1, 2021.

The NBR's notification, signed by Chairman Md. Abdur Rahman Khan and published on October 10, 2024, confirms that Grameen Bank will now be exempt from various taxes, including income tax, super tax, and business profit tax. The tax relief, effective immediately, is retroactive to October 1, 2024, and was granted under the Income Tax Act, 2023.

Grameen Bank, established by Nobel laureate Dr. Muhammad Yunus, had applied for the exemption after the previous one lapsed, but the request was initially rejected. With this new approval, the bank will benefit from the tax break until the end of 2029, provided it complies with all regulations, including timely submission of income tax returns.

Additionally, the non-profit religious charity As-Sunnah Foundation has also received a tax exemption on income from donations until June 2029, under similar conditions. The NBR issued two separate gazette notifications regarding these exemptions on Thursday.

Grameen Bank, which was established under a military ordinance in 1983, has continuously enjoyed tax exemptions under Section 33 of the Grameen Bank Ordinance. This provision remained valid even after the ordinance was codified into law in 2013.

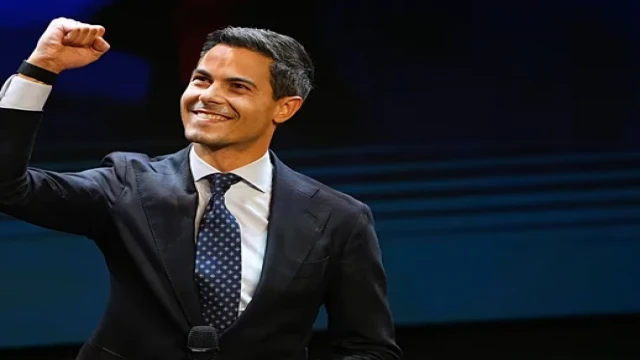

Dr. Muhammad Yunus, who served as managing director of Grameen Bank for 28 years, is now leading Bangladesh's interim government. Grameen Bank and Yunus were jointly awarded the Nobel Peace Prize in 2006 for their pioneering efforts in poverty alleviation through microcredit.

The bank, initially a pilot project in Jobra village, Chattogram, was formalized in 1983 with a focus on empowering marginalized communities through financial inclusion.

END/MSS/RH

Comment: