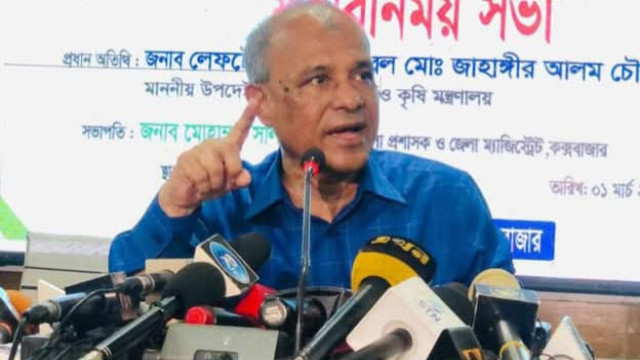

Dhaka, March 4, 2025 (V7N) - Bangladesh Bank (BB) Governor Dr. Ahsan H Mansur announced today that the 'Bank Resolution Act' is expected to be finalized by July 2025 to facilitate legal corrective measures such as mergers, acquisitions, liquidation, recapitalization, and consolidation of struggling banks.

Speaking at a roundtable titled "Path to Recovery for the Banking Sector" organized by The Business Standard, he emphasized the need for regulatory reforms. A banking regulatory simplification task force—including bank managing directors and financial experts—will be formed to clarify policies and streamline banking operations.

Dr. Mansur stressed that while the Bangladesh Bank is accelerating reform efforts, long-term changes will require continued commitment from the next elected government. The central bank’s independence is also a priority, with plans to establish it by July-August 2025, with support from the World Bank in implementing global best practices.

Regarding the recovery of weak banks, he stated that substantial liquidity support has been provided, but full stabilization will take 5-10 years. Bangladesh Bank will continue monitoring daily management activities to ensure financial recovery.

Additionally, to ease liquidity constraints, BB has relaxed the daily cash reserve ratio (CRR) for commercial banks. The CRR requirement has been reduced from 3.5% to 3.0%, effective tomorrow, though the bi-weekly and month-end CRR remains unchanged at 4.0%, according to a BB circular.

END/BUS/RH/

Comment: