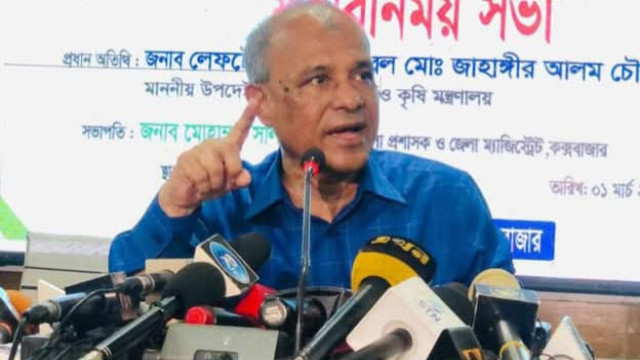

Dhaka, Mar 04 (V7N) - The Metropolitan Chamber of Commerce and Industry (MCCI) has urged the National Board of Revenue (NBR) to remove conditions on cash transactions in corporate tax, arguing that these restrictions hinder businesses from benefiting from the tax reductions introduced in the Finance Act, 2024. At a pre-budget meeting, MCCI President Kamran Tanvirur Rahman highlighted that Bangladesh's economy is 80% informal, making it difficult for businesses to comply with banking transaction requirements.

The Finance Act, 2024, mandates that expenditures or investments exceeding Tk 12 lakh must be conducted through banking channels to qualify for a 2.5% corporate tax reduction. However, business leaders argue that this condition is impractical due to the predominance of cash transactions in supply chains and rural areas. They have proposed a phased implementation of cashless transactions to avoid disruptions in business operations.

MCCI also recommended reforms such as basing taxes on income instead of turnover, automating tax administration to reduce evasion, and simplifying compliance processes. These measures aim to create a more business-friendly environment while ensuring sustainable revenue collection.

NBR Chairman Abdur Rahman Khan acknowledged the recommendations and reiterated the government's commitment to fostering a business-friendly tax regime. The discussions reflect ongoing efforts to balance formalizing the economy with minimizing disruptions for businesses heavily reliant on cash transactions.

END/BUS/RH/

Comment: