Asian stocks gained ground and the dollar weakened on Thursday as investors embraced new data suggesting a softening labor market, potentially giving the Federal Reserve room to lower interest rates. Wall Street continued its upward trajectory amid a holiday-shortened week, coinciding with upcoming national elections in Britain and France.

Recent improvements in US labor market data, along with signs of easing inflation, have lifted market sentiment following a period of stock market declines. Wednesday's reports showed fewer-than-expected job creations in the private sector and higher-than-forecasted jobless benefit claims. Additionally, a survey indicated a contraction in the services sector activity for June, the sharpest in four years.

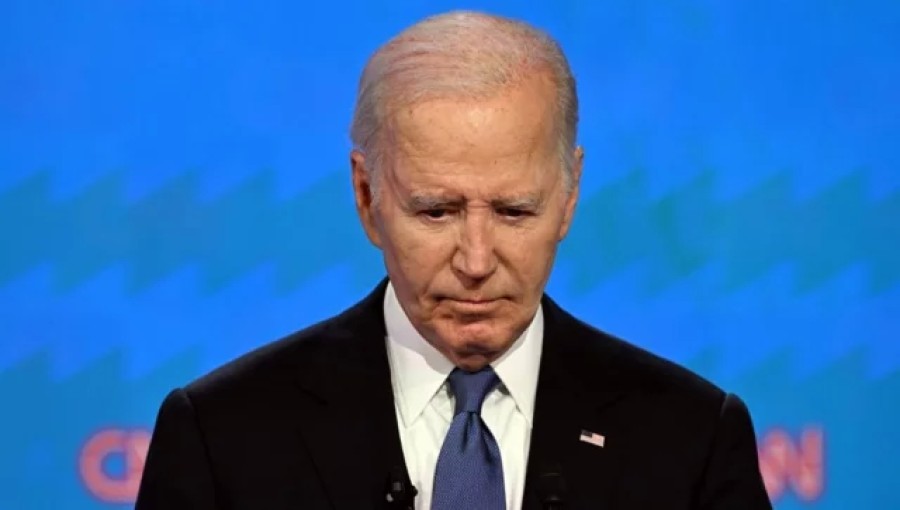

Further contributing to market optimism were remarks from Federal Reserve Chairman Jerome Powell, highlighting progress in battling inflation and addressing labor market challenges. Markets are now anticipating nearly two interest rate cuts this year, starting possibly in November.

Despite these positive indicators, Fed meeting minutes from June indicated caution among officials regarding premature rate cuts, emphasizing the need for more evidence of price stability. Inflation concerns persist, though recent softening in May data has bolstered confidence that price increases may stabilize.

On Wall Street, the Dow closed slightly lower, while the S&P 500 and Nasdaq reached new record highs. This positive momentum extended to most Asian markets, including Tokyo, Hong Kong, Sydney, Seoul, Taipei, Manila, and Jakarta. Shanghai, however, diverged, reflecting ongoing concerns about China's economic outlook.

Chinese investors, both domestically and globally, remain cautious, influenced by a high real interest rate and conservative fiscal policies. Analysts suggest that Chinese equities may continue to operate independently for the near term.

The dollar depreciated against major currencies following the labor market reports, while the euro gained support amid news of centrist and left-wing withdrawals from France's upcoming legislative election, aimed at countering far-right gains led by Marine Le Pen's National Rally.

In the UK, the pound strengthened ahead of Thursday's general election, where the Labour Party is expected to secure a significant victory over the Conservative Party, ending their 14-year governance.

Key market figures as of 0230 GMT include:

- Tokyo's Nikkei 225: Up 0.2% at 40,666.78

- Hong Kong's Hang Seng Index: Up 0.2% at 18,015.49

- Shanghai Composite: Down 0.2% at 2,975.23

- Euro/dollar: Up to $1.0792 from $1.0786

- Pound/dollar: Up to $1.2752 from $1.2737

- Dollar/yen: Down to 161.37 yen from 161.52 yen

- Euro/pound: Down to 84.63 pence from 84.65 pence

- West Texas Intermediate: Down 0.5% at $83.47 per barrel

- Brent North Sea Crude: Down 0.5% at $86.94 per barrel

- New York's Dow: Down 0.1% at 39,308.00

- London's FTSE 100: Up 0.6% at 8,171.12

Comment: