Nov 03, V7N- China's top lawmakers are set to convene on Monday to discuss an expansive economic stimulus package, a move analysts say could gain additional momentum depending on the outcome of the upcoming U.S. presidential election. With the economy facing sluggish consumer spending, a struggling property sector, and mounting government debt, Beijing has initiated measures such as rate cuts and relaxed home-buying restrictions. However, the specifics of a larger-scale stimulus have yet to be announced, frustrating investors hoping for a defined figure.

The Standing Committee of the National People's Congress (NPC), China’s highest legislative body led by Zhao Leji, is expected to approve around one trillion yuan ($140 billion) in additional budget allocations this week. Much of this is anticipated to support indebted local governments. Analysts, including those from Nomura, predict the committee may also authorize another trillion yuan for banks to address non-performing loans accumulated over the past four years, with the funds largely aimed at covering financial losses rather than directly boosting growth.

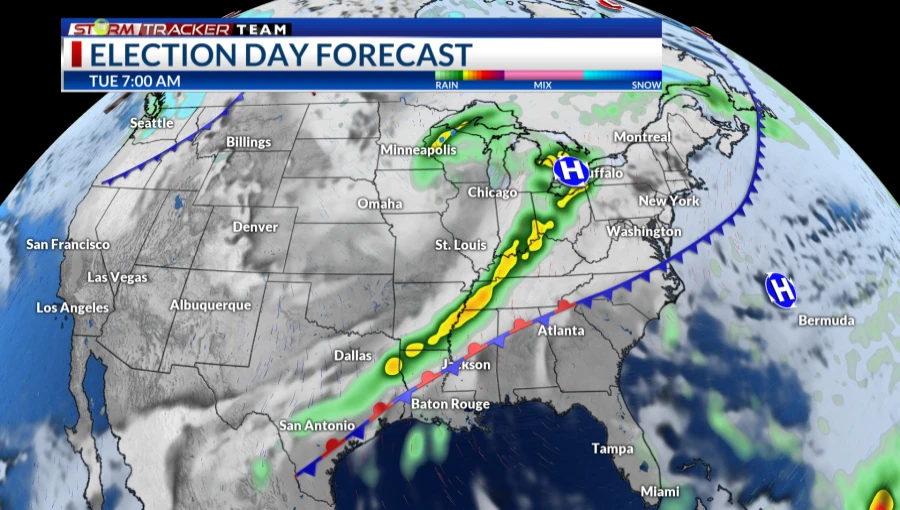

Nomura’s Chief China Economist, Ting Lu, indicated that the scope of Beijing's fiscal stimulus might adjust based on the U.S. election results. A win for former U.S. president Donald Trump, who has pledged steeper tariffs on Chinese imports, could prompt China to increase the package by 10 to 20 percent compared to a Kamala Harris victory.

Domestically, Beijing faces persistent economic challenges, notably in the real estate sector and household consumption. Years of rapid property development have left local governments burdened with unsold and incomplete housing projects, estimated by Natixis to cost up to 3.3 trillion yuan if repurchased by the government. The housing sector’s struggles have negatively affected consumer confidence, as mortgage holders feel less affluent, impacting spending behavior.

Local governments' debt management will be a focal point at the NPC meeting, with new accountability measures potentially requiring regular debt reporting to the NPC. Yet, as Alicia Garcia Herrero of Natixis points out, the roots of China's economic difficulties extend beyond local fiscal mismanagement, encompassing broader productivity losses tied to misallocated resources and subsidies in industrial sectors.

The legislative session, expected to conclude on Friday, may provide greater clarity on Beijing's approach to stabilizing its economy, a task likely influenced by both international dynamics and deep-seated domestic issues.

END/BUS/RH/

Comment: